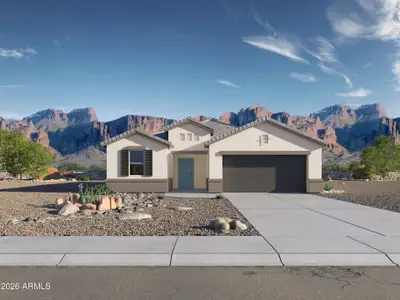

Phoenix Metropolitan Area new construction market: prices, trends, guides & homes as of January 2026

How much does a new home in Phoenix Metropolitan Area cost?

How are new home prices changing in Phoenix, AZ?

Home price data reflects current listings in Phoenix Metropolitan Area, Arizona, sourced from Jome and updated regularly

*Based on Jome markets

Get free consultation with Phoenix Metropolitan Area expert

Get a free, no-pressure consultation with our top Phoenix Metropolitan Area new-construction expert. They know every major builder, the best deals and incentives, and exactly what's happening in the local new-construction market.

Phoenix Metropolitan Area market overview

- Overall inventory6,934

- Single-family inventory6,660

- Townhouse inventory104

- Condo inventory121

- Multi-family inventory1

- Penthouse inventory0

- 1 bed inventory24

- 2 beds inventory459

- 3 beds inventory2,745

- 4+ beds inventory3,701

- Median home price$503,677.5

- Median sqft price$243.55

- Median 1 bed price$705,000

- Median 2 beds price$495,006.5

- Median 3 beds price$448,557.5

- Median 4+ beds price$537,995

- Min listing price$121,900

- Max listing price$50,000,000

- Min community price$184,990

- Max community price$22,500,000

Phoenix Metropolitan Area median price change

| Month | Median price | Change |

|---|---|---|

| March 2025 | $521,027 | - |

| April 2025 | $522,995 | +0.38% |

| May 2025 | $517,995 | -0.96% |

| June 2025 | $521,490 | +0.67% |

| July 2025 | $514,700 | -1.30% |

| August 2025 | $514,990 | +0.06% |

What are the most popular buyers' searches?

What it's like to live in Phoenix Metropolitan Area?

The Phoenix metro operates as America's fastest-growing major market and the Southwest's desert boomtown, where the sprawling Valley of the Sun spanning Maricopa and Pinal Counties with 5 million residents has experienced explosive growth adding 1.5 million people since 2010 as workers fled expensive California, retirees discovered year-round warmth at costs running 50% to 60% below coastal markets, and tech companies including Intel (employing 12,000 in semiconductor manufacturing), Taiwan Semiconductor Manufacturing Company (building $40 billion fabrication plants creating 10,000-plus jobs), and hundreds of others discovered Arizona's business-friendly environment and educated workforce, where healthcare employment through Banner Health, Dignity Health, HonorHealth, and Mayo Clinic Arizona serves the metro and attracts medical tourism, where tourism serving 45 million annual visitors to Grand Canyon, Sedona, Scottsdale resorts, and desert attractions employs tens of thousands, where logistics and distribution companies attracted by central Southwest location and proximity to California markets operate massive fulfillment centers, where aerospace and defense including Luke Air Force Base and contractors employ thousands, where finance and corporate operations including American Express, Fidelity, Charles Schwab maintain major facilities, and where this economic diversity, pro-business climate, and rapid growth distinguish Phoenix as the Southwest's economic engine.

However, this explosive growth has transformed Phoenix from affordable alternative into an increasingly expensive market where appreciation of 65% to 85% from 2019 to 2024 in many submarkets has eliminated much of the affordability advantage that once attracted migration, where quality new construction ranges $420,000 to $700,000 in desirable suburban locations (approaching Denver or Seattle suburbs despite desert location), where premium Scottsdale, Paradise Valley, and Arcadia areas command $850,000 to $8 million-plus, where median household income of $72,000 struggles with median home price approaching $460,000 creating disconnect only explainable by California equity refugees and corporate relocators bringing outside capital, where summer heat reaches genuinely dangerous levels with 110°F to 120°F temperatures June through September creating 100+ heat-related deaths annually and forcing residents indoors for four months, where water scarcity and Colorado River drought create existential questions about long-term sustainability as Lake Mead drops to historic lows threatening Phoenix's water supply, where traffic congestion on I-10, Loop 101, and Valley freeways has worsened dramatically as growth added cars faster than infrastructure, where property taxes remain low at 0.5% to 0.7% of assessed value creating $3,000 to $4,900 annual bills on $700,000 homes (among the nation's lowest), where Arizona's graduated income tax up to 4.5% creates modest burden, where property insurance costs remain moderate at $1,400 to $2,600 annually given absence of hurricanes though monsoon and hail create risks, and where the trade-offs involve accepting that Phoenix offers corporate opportunities, escape from California costs and taxes, year-round outdoor recreation (outside brutal summer months), no state income tax on retirement income for Social Security, and Southwestern desert beauty, but delivers these benefits with extreme heat that fundamentally limits livability four months annually, water crisis threatening long-term viability, relentless suburban sprawl extending 60+ miles creating car-dependent dystopia, and rapid growth overwhelming infrastructure in what has become America's cautionary tale of unsustainable desert boomtown growth where 5 million people in a valley that naturally supported 5,000 confront climate change, drought, and the reality that infinite growth in a finite desert may not be possible.

Why California exodus, tech sector growth, and retirement migration create boom despite water crisis

Phoenix's economic foundation rests on diversified employment spanning technology, healthcare, tourism, logistics, aerospace, finance, and corporate operations, combined with massive migration from expensive markets creating demand dynamics fundamentally different from Southeast metros.

The California exodus represents Phoenix's dominant demographic trend of the past decade. Over 200,000 net migrants from California since 2010 (more than any destination except Texas) brought equity, incomes, and housing expectations that transformed Phoenix's market. These migrants—fleeing California's high costs, taxes, traffic, regulations, and politics—sold $750,000 California homes purchasing $550,000 Phoenix properties banking $200,000 difference while gaining larger homes, newer construction, lower taxes, and (outside summer) better quality of life. However, the massive California influx brought higher housing expectations, drove appreciation that eliminated affordability Phoenix offered, increased traffic congestion, and created cultural tensions as conservative Arizona absorbed liberal Californians changing political dynamics. California equity refugees drove the 70% to 80% appreciation in many Phoenix suburbs 2019-2024, competing with locals earning Arizona wages who cannot remotely afford homes California transplants consider bargains.

Intel Corporation operates massive semiconductor manufacturing facilities in Chandler employing approximately 12,000 in chip fabrication, research and development, and operations paying $65,000 to $150,000-plus depending on engineering versus manufacturing roles. Intel's presence since 1980 established Phoenix as legitimate tech hub, with recent $20 billion investment in new fabrication plants ensuring continued employment. Taiwan Semiconductor Manufacturing Company (TSMC) announced $40 billion investment building cutting-edge semiconductor fabs in north Phoenix expected to employ 10,000-plus when operational mid-2020s, validating Phoenix's position as emerging "Silicon Desert" and creating anticipation of tech worker influx driving additional housing demand. However, semiconductor manufacturing requires massive water consumption—millions of gallons daily per fab—creating concerns given Colorado River crisis and Phoenix's water sustainability questions.

Technology sector beyond semiconductors includes Carvana (online used car sales, headquarters Phoenix), GoDaddy (domain registrar, Tempe headquarters), ON Semiconductor, Microchip Technology, and hundreds of software companies and startups employing workers earning $75,000 to $160,000. Remote workers maintaining California, Seattle, or expensive-market tech salaries relocated to Phoenix during pandemic discovering costs running 40% to 50% below departure cities, driving substantial demand purchasing $500,000 to $850,000 homes that felt accessible compared to Bay Area's $1.5 million starter homes.

Healthcare employment through Banner Health (Arizona's largest employer, operating 30 hospitals including Banner University Medical Center Phoenix, employing 52,000 across Arizona), Dignity Health, HonorHealth, Mayo Clinic Arizona (Scottsdale campus, tertiary care and research), and various systems totals 180,000-plus metro-wide. Nurses earn $68,000 to $98,000—solid salaries struggling with Phoenix's appreciated housing starting at $380,000 affordable areas. Physicians earn $200,000 to $500,000, finding that even high medical incomes strain to afford premium Scottsdale or Paradise Valley locations where homes exceed $1.2 million-plus. Mayo Clinic presence attracts medical tourism and positions Phoenix as medical destination.

Retirement migration remains substantial though California working-age professionals now outnumber retiree settlement. An estimated 40,000 to 60,000 retirees relocate to Phoenix annually from Midwest, Northeast, Pacific Northwest, and California seeking year-round warmth, escape from harsh winters, zero income tax on Social Security, affordable golf (Phoenix metro has 200-plus courses), and active outdoor lifestyles. However, many retirees discover brutal summer heat (June through September lows rarely below 90°F, highs 110°F to 120°F) forces indoor confinement four months, creating "reverse snowbirds" who flee Phoenix summers for cooler locations or questioning whether year-round desert heat proves sustainable as they age.

Snowbird seasonal residents—estimated 300,000 to 400,000 winter visitors—own second homes or rent properties November through April enjoying perfect winter weather (60°F to 80°F daily highs), then returning to Canada, Minnesota, Wisconsin, and Northern states for summer. This seasonal population creates demand for second homes, drives winter tourism economy, but leaves properties vacant during brutal summers.

Tourism serving 45 million annual visitors generates $25+ billion economic impact. While most visitors pass through Phoenix accessing Grand Canyon (two hours north), Sedona (two hours north), or other Arizona attractions, substantial numbers visit Scottsdale resorts, spring training baseball (15 teams train in Phoenix area attracting 1.8 million fans), golf tourism, and desert recreation. Hotels, resorts, restaurants, and tourism services employ tens of thousands in positions paying $28,000 to $58,000—wages struggling with Phoenix housing costs.

Logistics and distribution attracted by central Southwest location serving California, Southwest, and Mexico border trade operate massive fulfillment centers. Amazon operates multiple facilities employing thousands, Walmart, Target, various 3PLs, and distribution operations employ workers earning $38,000 to $75,000.

Aerospace and defense employment includes Luke Air Force Base (west Valley, F-35 and F-16 training, employing 7,000 military and civilian), Boeing operations, Raytheon Missiles & Defense, Honeywell Aerospace, and various contractors employing thousands in positions paying $55,000 to $130,000.

Financial services and corporate operations include American Express (major operations center, employing 6,000), Fidelity Investments, Charles Schwab, USAA, and various banks and financial companies attracted by business-friendly environment and costs below coastal markets. Positions pay $50,000 to $140,000 creating white-collar professional employment.

Higher education through Arizona State University (Tempe campus plus West, Polytechnic, Downtown campuses, 75,000 students making it one of America's largest universities), University of Arizona Phoenix campus, Grand Canyon University, and various institutions employ tens of thousands though faculty salaries ($55,000 to $135,000) struggle with appreciated Phoenix housing.

The tax structure delivers Arizona's graduated income tax from 2.5% on income up to $27,808 to 4.5% on income over $166,843, creating tax liability of approximately $2,250 annually on $50,000 income, $4,500 on $100,000, $9,000 on $200,000—moderate burden lower than California's 13.3% top rate attracting California refugees. However, Arizona fully taxes Social Security and retirement income at same rates affecting retirees. Property taxes remain among the nation's lowest at 0.5% to 0.7% of assessed value (limited valuation ratio creates effective rates far below assessment rates). On a $600,000 home, annual property tax bills range approximately $3,000 to $4,200—dramatically lower than Texas ($15,000 on same value) or Northeast creating substantial savings. Arizona caps assessment increases at 5% annually for primary residences providing some protection though less aggressive than California's Prop 13.

Sales tax runs 8.0% to 9.3% across metro—among the nation's highest—with state collecting 5.6%, counties adding 0.7% to 1.8%, and cities adding 2% to 3%, creating combined burden.

The cost of living has increased catastrophically particularly in desirable areas, though Phoenix maintains better value than California or coastal markets it competes against. Quality new construction ranges $420,000 to $700,000 in desirable locations including Gilbert (southeast Valley, family-oriented, top schools, corporate headquarters), Chandler (southeast, Intel proximity, diverse, growing), Scottsdale suburbs (north Scottsdale, affluent, desert views), Peoria and Surprise (northwest Valley, affordable, family-oriented), Queen Creek (far southeast, explosive growth, affordable), Goodyear (west Valley, growing rapidly), and areas throughout sprawling Valley. Premium locations including Scottsdale (Paradise Valley borders, Camelback Mountain, Old Town, DC Ranch), Paradise Valley (ultra-wealthy enclave, estates on desert hillsides, $2 million to $20 million-plus), Arcadia (central Phoenix, Camelback Mountain proximity, $850,000 to $5 million), and exclusive enclaves command highest prices. Downtown Phoenix condos range $280,000 to $1.2 million. The appreciation has been explosive and devastating—65% to 85% from 2019 to 2024 in many suburban submarkets, 50% to 70% even in outer areas. Homes selling for $280,000 in 2019 now require $480,000-plus. However, Phoenix still offers 20% to 30% better value than San Diego, 30% to 40% below Bay Area, 25% to 35% below Seattle, creating relative affordability attracting California and coastal refugees.

The climate represents Phoenix's defining characteristic—extreme Sonoran Desert conditions creating genuinely dangerous summer heat that fundamentally limits livability four months annually. June through September brings relentless oppressive heat with daily highs 108°F to 120°F, overnight lows rarely below 90°F creating no relief, asphalt radiating heat making outdoor surfaces literally burn skin on contact, air conditioning running continuously consuming electricity, and heat-related deaths exceeding 100 annually as homeless populations, outdoor workers, and vulnerable individuals succumb to extreme temperatures. October through May provides perfect weather—60°F to 85°F daily highs, sunny, dry, comfortable—creating the "eight months of heaven" attracting migration. However, the four months of hell require acknowledging: summer outdoor activities occur before 9 AM or after 8 PM only, children cannot play outside midday June through August, hiking trails close due to rescue frequency from heat exhaustion, and residents essentially become prisoners indoors for four months. Water scarcity represents existential threat—Phoenix draws water from Colorado River, Salt River Project, and groundwater, but Colorado River flows have declined 20% since 2000 due to climate change and 20-year megadrought, Lake Mead (Phoenix's primary Colorado River source) dropped to historic lows threatening water delivery, groundwater overdrafting continues despite regulations, and climate models project continued aridification making Phoenix's water supply genuinely uncertain long-term. Monsoon season July through September brings dust storms (haboobs), flash flooding, and severe thunderstorms creating brief but intense hazards. Winter freezes occasionally damage desert landscaping though snow remains extremely rare in Valley (mountains surrounding receive snow). The desert beauty—saguaro cacti, desert mountains, dramatic sunsets—provides aesthetic appeal, though dust, blowing sand, and brown landscapes lacking greenery require adjustment for migrants from lush regions.

Understanding Phoenix by buyer profile and California exodus dynamics

Phoenix's explosive growth, California migration dominance, tech sector emergence, and retirement appeal create buyer profiles where California equity refugees and corporate relocators drive appreciation while local workers face exclusion.

For California Equity Refugees and Coastal Migrants: California migrants represent Phoenix's dominant buyer segment driving appreciation. These buyers—typically ages 28 to 65 earning $85,000 to $220,000-plus or retirees with accumulated California equity—sold $650,000 to $1.2 million California homes (modest properties in San Diego, Orange County, Bay Area, or Los Angeles) purchasing $480,000 to $850,000 Phoenix properties, banking $170,000 to $350,000 difference while gaining 800 to 1,200 additional square feet, newer construction, three-car garages, resort-style pools, and lower taxes. They purchase throughout the Valley prioritizing new construction (Gilbert, Chandler, Queen Creek, Goodyear, Surprise, Buckeye—explosive growth areas), Scottsdale for upscale resort lifestyle ($650,000 to $2 million), or premium central areas (Arcadia, Paradise Valley fringe). California migrants bring housing expectations calibrated to departure markets—$650,000 for 2,800 square feet feels like bargain compared to $1.1 million for 1,600 square feet in San Diego—making them willing to pay prices locals consider insane. They value escape from California's 13.3% income tax (Arizona's 4.5% saves $8,700 annually on $100,000 income), lower costs despite Phoenix appreciation, pro-business Republican governance versus California's progressive policies, and year-round warmth. However, many discover brutal summer heat proves worse than expected, water concerns create anxiety absent in water-abundant California, sprawling car-dependent Valley requires driving everywhere unlike California's beach walkability, and Phoenix's cultural amenities, dining, and entertainment pale compared to Southern California. Some "half-back" returning to California within 5 years discovering Phoenix trade-offs unsustainable, though most remain accepting heat for financial benefits.

For Tech Workers and Intel/TSMC Employees: Intel's 12,000 employees plus future TSMC workers create concentrated tech buyer demand. Semiconductor engineers earning $90,000 to $150,000 purchase homes from $420,000 to $680,000 primarily in Chandler (closest to Intel), Gilbert (adjacent, excellent schools), Tempe (urban, close to ASU and tech companies), or Scottsdale accepting longer commutes for upscale lifestyle. Senior engineers and managers earning $130,000 to $200,000-plus purchase homes from $600,000 to $1.2 million in premium Scottsdale, Gilbert, or central areas. Dual-income Intel households where both spouses work tech creating combined $180,000 to $300,000 represent highest earners, purchasing homes from $700,000 to $1.5 million. Remote tech workers maintaining Bay Area, Seattle, or expensive-market salaries relocated during pandemic purchased $500,000 to $950,000 homes, finding Phoenix costs running 50% below departure cities justified heat trade-offs. However, Phoenix tech salaries (lower than coastal markets) combined with appreciated housing create affordability challenges despite "affordable tech hub" narrative. TSMC's future 10,000 employees expected mid-2020s create anticipation of additional demand in north Phoenix areas near fabs.

For Retirees Seeking Year-Round Desert Warmth: Retirees relocating from cold climates represent substantial buyer segment though California working-age now dominates. Retirees—typically ages 62 to 76—bringing $300,000 to $700,000 from selling Midwest, Northeast, Pacific Northwest, or California homes purchase properties from $350,000 to $650,000 in retirement-oriented communities including Sun City (age-restricted, northwest Valley, 38,000 residents, affordable), Sun City West (similar, newer, 42,000 residents), Sun City Grand (premium age-restricted), active adult communities throughout Valley, or regular subdivisions in Peoria, Surprise, Goodyear. They seek single-story ranch layouts (stairs challenging as age), desert landscaping eliminating yard work (rocks and cacti versus grass), resort amenities (golf courses, pickle ball, swimming pools), proximity to healthcare (Mayo Clinic Scottsdale, Banner facilities), and year-round outdoor activities. Arizona's zero tax on Social Security (first $12,950 single/$25,900 married exempt, remainder taxed at graduated rates) provides modest benefit though less generous than Florida's zero income tax on all retirement income. Many retirees discover brutal summer heat (110°F to 120°F June through September) proves unsustainable as they age, with heat limiting outdoor activities they relocated to Phoenix enjoying, creating "reverse snowbirds" who flee summers to Colorado, Pacific Northwest, or returning to home states. Some maintain Arizona homes as winter residences, summering elsewhere.

For Snowbirds and Seasonal Residents: An estimated 300,000 to 400,000 seasonal residents—primarily Canadians and Upper Midwest/Pacific Northwest residents—own second homes or rent properties November through April enjoying perfect winter weather (60°F to 80°F, sunny, dry), then returning north for summer avoiding Phoenix's brutal heat. These buyers purchase condos and homes from $280,000 to $650,000 specifically for seasonal use, often leaving properties vacant May through October. The seasonal population creates demand spikes during "season" when restaurants, golf courses, and entertainment fill with winter visitors, then ghost-town conditions summer months when snowbirds flee and even year-round residents minimize outdoor activities.

For Healthcare Professionals Serving Rapid Growth: Banner Health, Mayo Clinic Arizona, and various systems employ nurses, physicians, and medical staff. Nurses earning $68,000 to $98,000 find Phoenix challenging—a registered nurse earning $78,000 struggles qualifying for homes starting at $380,000 in affordable areas given insurance, taxes, and HOA fees adding $550 to $750 monthly. Dual-nurse households earning combined $140,000 to $190,000 purchase homes from $450,000 to $650,000 in Gilbert, Chandler, Peoria, or various Valley suburbs. Physicians earning $200,000 to $500,000 purchase homes from $650,000 to $2 million-plus in Scottsdale, Paradise Valley, Arcadia, or premium areas. Healthcare workers often express frustration that Phoenix housing appreciated so dramatically that even solid healthcare salaries struggle affording desirable areas, while California migrants with equity easily outbid locals.

For Growing Families Prioritizing Schools and Safety: School district quality drives family decisions across multiple districts. Gilbert Public Schools, Chandler Unified School District, and Scottsdale Unified School District maintain generally strong reputations creating concentrated family demand. Specific schools in Paradise Valley Unified, Cave Creek Unified, and Fountain Hills also rate highly. Phoenix Union High School District (urban Phoenix) and various other districts show challenges requiring careful research. Price points range from $400,000 in solid suburban areas with good schools to $700,000-plus in top Scottsdale or Gilbert zones. Families achieving homeownership in desirable school areas typically represent dual-income professional households earning $130,000 to $220,000—tech workers, healthcare professionals, corporate employees, or California migrants bringing equity.

For Scottsdale Luxury and Resort Lifestyle Seekers: Scottsdale represents Phoenix's premier luxury market—upscale resorts, golf courses, shopping, dining, and Sonoran Desert mountain views attract affluent buyers. North Scottsdale areas including DC Ranch, Silverleaf, Desert Mountain, and various luxury communities command $1 million to $8 million-plus for golf course estates and mountain properties. Central Scottsdale (Old Town area, Camelback Mountain proximity) features $850,000 to $5 million properties. Scottsdale attracts wealthy retirees, successful business owners, corporate executives, California equity millionaires, and affluent professionals seeking resort lifestyle, accepting costs exceeding other Valley areas 40% to 60% for Scottsdale cachet, mountain views, golf access, and upscale amenities.

For Affordable Outer Valley Buyers: Far outer areas including Buckeye (west Valley, fastest-growing U.S. city 2020-2021), Queen Creek (southeast), Casa Grande (between Phoenix and Tucson), Maricopa (south), and San Tan Valley (southeast) offer new construction from $340,000 to $480,000—most affordable Valley options though requiring brutal 60 to 90-minute commutes to central Phoenix or east Valley employment through traffic. These areas attract working families, service workers, and buyers unable to afford inner Valley, accepting extreme commutes and lack of established infrastructure for lower entry costs.

For Downtown Phoenix Urban Lifestyle Seekers: Downtown Phoenix experienced substantial revitalization with high-rise condos, restaurants, arts district, sports venues (Chase Field—Diamondbacks, Footprint Center—Suns/Mercury), and urban living attracting young professionals ages 25 to 40. Downtown condos range $280,000 to $1.2 million depending on building and square footage. However, downtown living proves challenging given Phoenix's car-dependent sprawl where walking proves difficult due to heat, limited urban density compared to genuine walkable cities, and persistent homelessness and urban challenges. Many who choose downtown are young tech workers, corporate professionals, ASU alumni, or transplants from genuine urban cities discovering Phoenix downtown doesn't replicate Manhattan or San Francisco urban energy.

For Service Workers and Working-Class Facing Exclusion: Tens of thousands of restaurant workers, retail employees, hotel staff, tourism workers, and service industry employees earning $28,000 to $58,000 annually face severe exclusion from Phoenix homeownership. Even dual-income service households earning combined $60,000 to $100,000 struggle qualifying for homes starting at $360,000 in most affordable distant areas. Many service workers commute 45 to 90 minutes from Casa Grande, Apache Junction, or outlying areas where housing somewhat more accessible. This represents Phoenix's central inequality—California equity and tech workers drove appreciation pricing out working-class serving the economy.

For First-Time Buyers Facing Difficult Barriers: Phoenix appreciation has severely challenged first-time buyer access. Townhomes start around $280,000 in outer areas requiring $9,800 down with FHA loans. Starter single-family homes begin at $350,000 in distant locations requiring $12,250 down. Young professionals, healthcare workers, and working families earning $65,000 to $115,000 combined struggle qualifying given appreciation of 70% to 80% while incomes rose only 20% to 25%. Many first-time buyers are young tech workers beginning Intel careers, healthcare workers, or military personnel using VA loans.

The moderate costs beyond mortgage payments despite water crisis

Your actual monthly housing expense in Phoenix extends beyond principal and interest, with Arizona's moderate taxes creating manageable though meaningful costs.

- Property taxes remain among nation's lowest at 0.5% to 0.7% of assessed value (limited valuation ratio). On a $600,000 home, annual property tax bills range approximately $3,000 to $4,200—dramatically lower than most states creating substantial savings. Arizona caps assessment increases at 5% annually for primary residences.

- State income tax: Arizona's graduated rate up to 4.5% creates tax liability approximately $2,250 annually on $50,000 income, $4,500 on $100,000, $9,000 on $200,000. However, Arizona taxes Social Security and retirement income affecting retirees.

- Sales tax: 8.0% to 9.3% across metro—among nation's highest.

- Homeowner's insurance: Moderate costs given no hurricanes. Annual premiums range $1,400 for newer suburban homes to $2,200 for older homes or higher coverage to $2,800 for specific situations. Desert location eliminates flood insurance for most properties. Monsoon hail and dust storms create some risk. New construction typically runs $1,600 to $2,100 annually.

- HOA fees: Nearly universal in Phoenix given desert landscaping, community pools, and master-planned developments. Standard suburban communities run $80 to $220 monthly, premium communities with golf courses or extensive amenities run $300 to $800 monthly, luxury Scottsdale communities can exceed $1,000 monthly.

- Utility costs: Summer air conditioning creates extreme costs. Arizona Public Service (APS) and Salt River Project (SRP) serve different areas. Summer electric bills June through September for 2,500 square foot homes easily reach $350 to $550 monthly running AC continuously to maintain 78°F to 82°F indoors when outside temps exceed 115°F. Newer construction with proper insulation, efficient HVAC, and radiant barrier roofing runs 30% to 40% lower. Annual electric costs of $3,600 to $5,500 represent substantial ongoing expenses.

- Water bills remain moderate despite scarcity—$50 to $90 monthly for typical household, though desert landscaping reduces irrigation needs versus grass lawns. Combined costs—property taxes around $300 monthly, state income tax around $325 monthly for $90,000 household, insurance $140 to $200 monthly, HOA fees $120 to $280 monthly, summer electric costs $400 monthly averaged yearly—create $1,285 to $1,505 monthly beyond principal and interest.

What new construction delivers in desert boomtown

New construction dominates Phoenix market given rapid growth and desert development patterns.

- Desert-appropriate construction: Tile roofs, stucco exteriors, desert landscaping (rocks and native plants versus grass), covered patios, resort-style pools, three-car garages standard.

- Energy efficiency critical: Proper insulation, radiant barrier roofing, efficient HVAC with SEER ratings 16+, Low-E windows, and proper orientation reducing summer heat gain essential given extreme temperatures.

- Modern floor plans: California migrants and professionals expect open concepts, home offices, chef kitchens, primary suites with spa bathrooms, and indoor-outdoor living spaces.

- Smart home technology: Professional buyers expect structured wiring, smart thermostats managing cooling costs, and security systems.

- Warranty protection: Builder warranties provide protection in rapidly-built developments.

Construction timelines in boom market

- For inventory homes, closings happen within 50 to 110 days.

- For to-be-built homes, realistic expectations run 9 to 14 months given boom market capacity constraints. Summer heat affects construction productivity though work continues year-round. Monsoon season July through September brings flash flooding and dust storms creating brief delays.

Financing in California refugee market

Most builders offer incentives from $8,000 to $18,000 in closing cost credits. On a $600,000 home with approximately $300 monthly property tax, $165 monthly insurance, $180 monthly HOA fees, total housing payment reaches approximately $4,700 monthly. This requires household income exceeding $165,000—explaining why working-class faces exclusion while California equity refugees and tech workers dominate.

Why Phoenix-specialist representation matters critically

Phoenix's extreme heat, water crisis, California migration dynamics, and desert sprawl make specialized representation essential.

Independent buyer's agents help navigate which areas offer best value versus California overpricing, evaluate realistic summer heat tolerance (visiting in February doesn't prepare buyers for 120°F July), understand water sustainability concerns and which areas face restrictions, assess HOA quality managing desert common areas and pools, identify builder reputations in rapidly-built developments, and ensure buyers—particularly those from moderate climates—understand Phoenix realities: extreme heat genuinely limits livability four months annually, water crisis represents existential threat to long-term viability, car-dependent sprawl requires driving everywhere, and California migration drove appreciation pricing out locals, while recognizing Phoenix offers escape from California costs and taxes, corporate opportunities, tech sector growth, year-round recreation (outside summer), golf paradise, Sonoran Desert beauty, and relative affordability versus coastal alternatives in America's fastest-growing major metro where 5 million people in the desert confront climate change, drought, and the question of whether infinite growth in a finite water-scarce environment proves sustainable long-term, creating the Southwest's boom and bust cautionary tale where prosperity and environmental limits collide in the Valley of the Sun.

Where can I find new homes?

Browse currently available new construction homes, communities, and floor plans across the Phoenix Metropolitan Area. All listings are updated daily with the latest inventory from builders. Browse all communities & new homes in Phoenix Metropolitan Area

Top-rated new construction communities in Phoenix Metropolitan Area

Master planned communities in Phoenix Metropolitan Area

Browse communities & homes in Phoenix Metropolitan Area cities

Real estate in Phoenix Metropolitan Area

As of early 2026, the Phoenix Metropolitan Area real estate market has stabilized into a balanced landscape, driven by the region's continued evolution into the "Silicon Desert." The median home price currently sits near $455,000, offering a sustainable entry point compared to coastal tech hubs. While inventory remains tighter in central districts like Scottsdale and Tempe, the real opportunity lies in the expanding exurbs—such as Buckeye and Queen Creek—where new construction is flourishing and offering modern amenities at competitive prices. To support this growth, programs like the "Home in Five" Advantage and the Arizona Industrial Development Authority’s "Home Plus" continue to provide critical aid. Eligible buyers can receive up to 5% of their loan amount for down payment and closing costs. With rising inventory levels and these robust financial tools available, buyers now have the leverage to secure a home in one of the nation’s most dynamic economies without the frenzy of previous years.

Newly released communities

Recently listed homes

Recently published floor plans

The most popular new construction builders in Phoenix Metropolitan Area

Read about new construction on Jome blog

Frequently asked questions

What is the current median sale price for a property in Phoenix Metropolitan Area?

As of December 2025, the property market in Phoenix Metropolitan Area, showcases a median sale price of $509,990. This market analysis includes a portfolio of 6766 newly built homes, each crafted by one of the 90 innovative developers in the area, highlighting a diverse range of residential options.

Who are the major developers of new construction homes in Phoenix Metropolitan Area?

Phoenix Metropolitan Area's real estate market offers many new construction options, with Lennar, D.R. Horton, Taylor Morrison, Richmond American Homes and Risewell Homes as the main developers. These builders create communities suited to modern living.

What are the closing costs in Phoenix?

Phoenix is a highly competitive builder market, which works in your favor. While standard closing costs (Title, Escrow, Lender Fees) can run 2-3% of the purchase price, it is currently standard practice for builders to cover the entirety of these costs. Developers are using these incentives to lock in buyers, often contributing $5,000 to $10,000 to wipe out your transaction fees completely—provided you use their preferred lender. This allows you to move in with significantly less cash out of pocket. To find these "zero closing cost" deals, check our inventory of Phoenix Homes with Builder Incentives.

Why are electric bills so much lower in new homes?

In the Arizona summer, your electric bill is effectively a second mortgage payment—unless you buy new. The difference comes down to Spray Foam Insulation. Most builders in 2025 have standardized "cathedralized" spray foam attics, which keep your ductwork in a semi-conditioned space rather than a 150-degree oven. Combined with high-efficiency HVAC systems and Low-E windows, a new home typically costs 30% to 50% less to cool than a block-construction home from the 1990s. To stop bleeding cash to the utility company, search for Energy Star Certified New Homes.

How does the TSMC plant affect the housing market?

The massive Taiwan Semiconductor (TSMC) plant in North Phoenix is the single largest economic driver in the state. It has transformed the North Phoenix and Peoria housing markets from sleepy outer suburbs into high-demand "Tech Corridors." Home values in zip codes near the plant are projected to outperform the regional average as thousands of high-wage suppliers and engineers move in. For buyers, purchasing in this corridor now is a strategic play on future appreciation. To invest near this economic hub, explore New Homes near TSMC North Phoenix.

Is it better to buy in the East Valley (Queen Creek/Gilbert) or West Valley (Buckeye/Surprise)?

This is a trade-off between "Lifestyle" and "Affordability." The East Valley—anchored by Intel and high-end retail—is the premium choice, offering top-rated schools and lush, established amenities, but prices in Gilbert and Queen Creek reflect that status. The West Valley (Buckeye, Surprise, Goodyear) is the "Growth Engine." Driven by logistics jobs and the Loop 303 expansion, this area offers brand-new homes for $100,000 to $150,000 less than the East Valley. If you want maximum square footage for your dollar, go West; if you want the established dining and nightlife scene, go East.

Is my water supply safe in a new community?

Despite the scary headlines, buying a home in a major master-planned community is the safest water bet you can make. Inside the Active Management Areas (AMAs) of Phoenix, state law strictly prohibits builders from selling a home unless they have a Certificate of Assured Water Supply—guaranteeing water availability for 100 years. This protection does not exist for older homes on private wells or in rural "wildcat" subdivisions. By purchasing in a regulated master plan, you are backed by the Central Arizona Groundwater Replenishment District (CAGRD). To ensure your investment is secure, filter for Master-Planned Communities in Phoenix.